Land Transaction Tax rates for Wales and Land and Building Transaction Tax rates for Scotland were updated in January 2025. Stamp Duty Land Tax rates for England and Northern Ireland were updated on 1 April 2025.

In England and Northern Ireland

What is Stamp Duty Land Tax?

Stamp Duty Land Tax (SDLT) is a tax that you may need to pay when you buy a property in England or Northern Ireland.

Stamp Duty Land Tax rates

If you’re buying a residential property, the amount of SDLT you owe will depend on the price you pay for the property. It also depends on whether it is your only home or an additional property, for example, a buy-to-let or a second home.

There are different rates depending on the price of the property.

First time buyers

First time buyers may pay less stamp duty. If you buy a property for £500,000 or less, you pay no SDLT on the first £300,000, and 5% on the portion between £300,001 and £500,000.

Property price: £350,000

Portion 1

(£0-£125,000)

0% tax so SDLT = £0

(£125,001-£250,000)

2% tax so SDLT = £2,500

(£250,001-£350,000)

5% tax so SDLT = £5,000

Total Stamp Duty Land Tax owed = £0 + £2,500 + £5,000 = £7,500

Use our calculator to see how much Stamp Duty Land Tax you'll need to pay.

More about stamp duty in England and Northern Ireland

When do you pay Stamp Duty Land Tax?

If you're buying in England or Northern Ireland, you have just 14 days to pay SDLT from the date you complete on the purchase of your property (or the date you’re due to get the keys on the contract). If you miss this date, you may have to pay a £100 fine and possibly interest.

How do you pay Stamp Duty Land Tax?

Usually, your solicitor or conveyancer will ask you to pay the SDLT you owe to them and will then send off the SDLT return and pay the bill for you. You’re still legally responsible for making sure this is done on time though.

When is Stamp Duty Land Tax not payable?

Can Stamp Duty Land Tax be paid in instalments?

Can I pay Stamp Duty Land Tax by credit card?

Can Stamp Duty Land Tax be added to my mortgage?

Can I claim Stamp Duty Land Tax back?

For properties sold on or after 29 October 2018 the refund must be claimed within 12 months of the latest of the following:

For properties sold on or before 28 October 2018 the refund must be claimed within three months of selling or gifting your previous home. Or it can be claimed within 12 months of filing your SDLT return. Use whichever date is later.

There may be exceptional circumstances that allow you to ask for money back if you sell your original home after the 3 year limit.

In Scotland

What is Land and Buildings Transaction Tax?

Land and Buildings Transaction Tax (LBTT) is a tax that you may need to pay when you buy a property in Scotland.

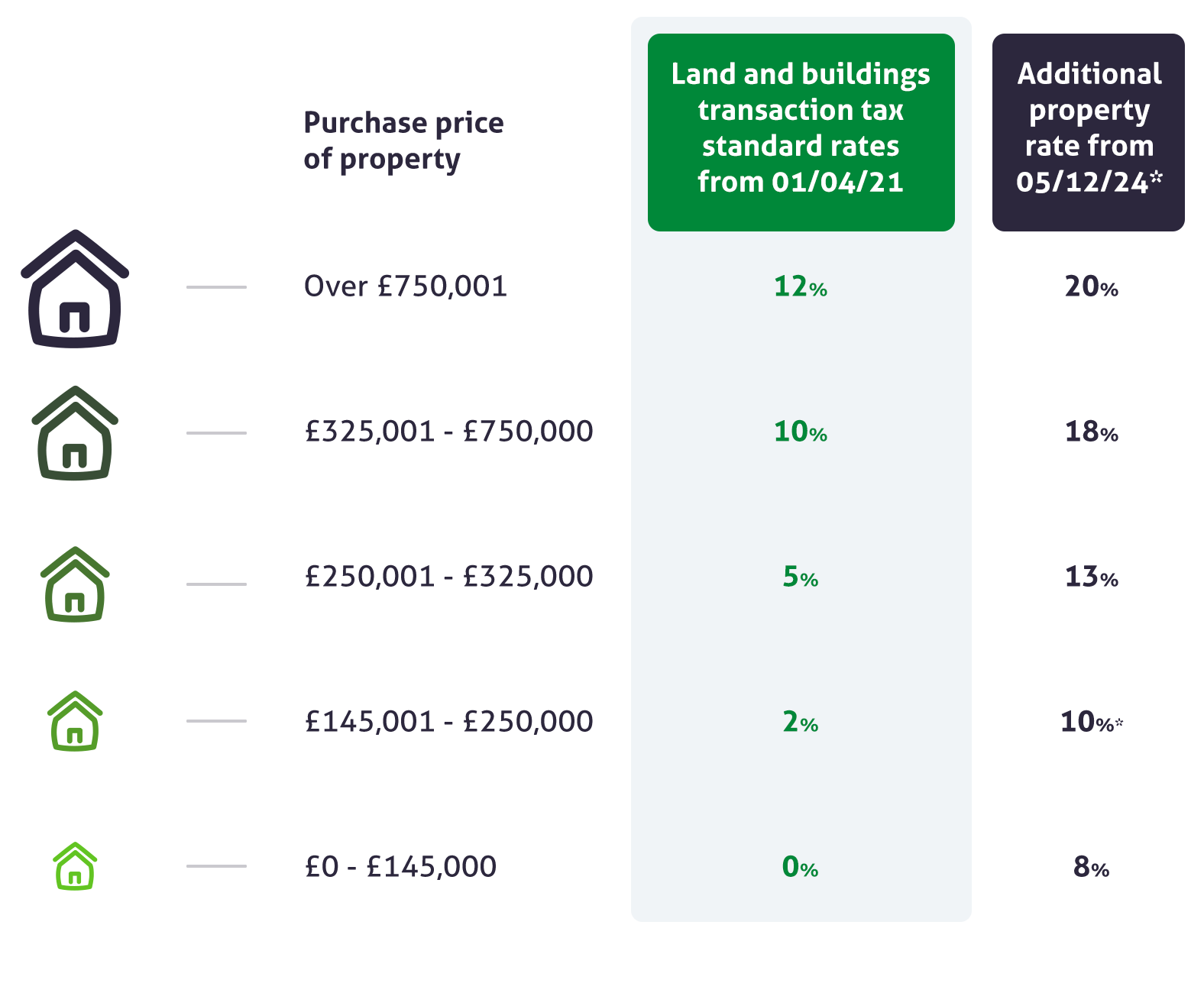

Land and Buildings Transaction Tax rates

If you’re buying a residential property, the amount of LBTT you owe will depend on the price you pay for the property. It also depends on whether it is your only home or an additional property, for example, a buy-to-let, or a second home.

There are different rates depending on the price of the property.

First time buyers in Scotland

First time buyers don’t pay any Land and Buildings Transaction Tax on properties up to £175,000.

Land and Buildings Transaction Tax rates in Scotland are as follows:

* Properties under £40,000 are not subject to the additional Land and Buildings Transaction Tax Rates. For jointly owned property, a property share valued under £40,000 is also not subject to the additional Land and Buildings Transaction Tax Rates.

Figures referenced from https://www.gov.scot/policies/taxes/land-and-buildings-transaction-tax/

Property price: £350,000

Portion 1

(£0-£145,000)

0% tax so LBTT = £0

Portion 2

(£145,001-£250,000)

2% tax so LBTT = £2,100

Portion 3

(£250,001-£325,000)

5% tax so LBTT = £3,750

Portion 4

(£325,001-£350,000)

10% tax so LBTT = £2,500

Total Land and Buildings Transaction Tax owed = £0 + £2,100 + £3,750 + £2,500 = £8,350

Use our calculator to see how much Land and Buildings Transaction Tax you'll need to pay.

In Wales

What is Land Transaction Tax?

Land Transaction Tax (LTT) is a tax that you may need to pay when you buy a property in Wales.

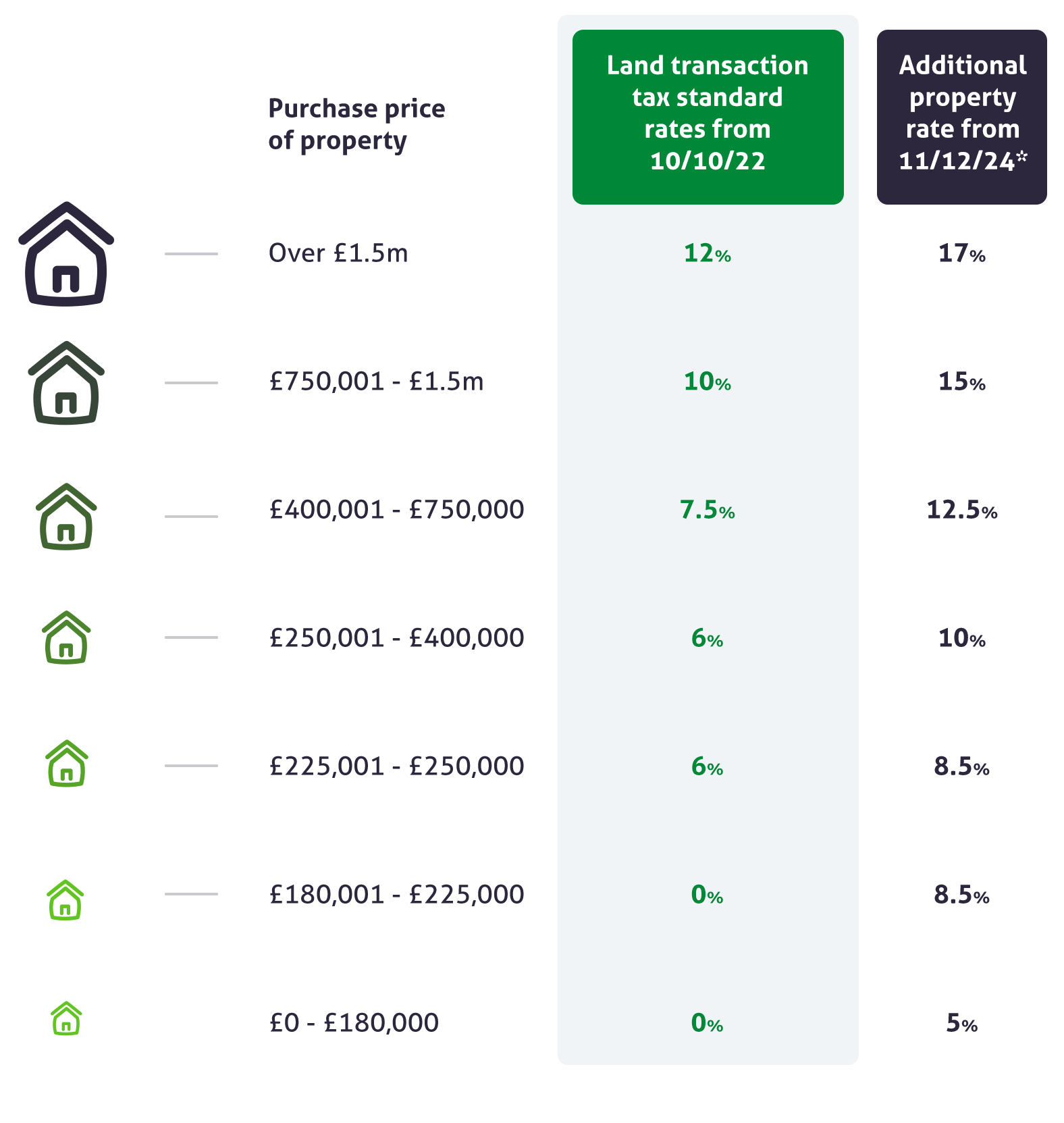

Land Transaction Tax rates

If you’re buying a residential property, the amount of LTT you owe will depend on the price you pay for the property. It also depends on whether it is your only home or an additional property, for example, a buy-to-let or a second home.

There are different rates depending on the price of the property.

First time buyers in Wales

There are no special rates for first time buyers in Wales.

Land Transaction Tax rates in Wales are as follows:

* Properties under £40,000 are not subject to the additional Land Transaction Tax rates

Figures referenced from https://gov.wales/land-transaction-tax-rates-and-bands

Property price: £350,000

Portion 1

(£0-£225,000)

0% tax so LTT = £0

Portion 2

(£225,001-£350,000)

6% tax so LTT = £7,500

Total Land Transaction Tax owed = £0 + £7,500 = £7,500

Use our calculator to see how much Land Transaction Tax you'll need to pay.